It’s not what you look at that matters, it’s what you see………Henry David Thoreau

The notion that Strategic Planning is the pathway to Strategy is still widely held in many organizations. The problem is that Strategic Planning is typically long on analyses but short on insight and creativity.

Strategic Planning typically involves weeks or months of analytical pre-work using a myriad of Strategic Management tools and frameworks, all of which goes into Strategic Planning’s ‘black box’. Then, almost by magic, out of the box pops 3-to-5-year predictions, a set of firm specific objectives and a ‘laundry list’ of fragmented threads of activity, typically called strategies, intended to achieve those objectives. But, there is no overarching logic that underpins these so called strategies and that links them to Customer and Organization Value Creation.

To the extent that there is an algorithm in the ‘box’ it is usually extrapolation of history overlaid with corporate politics and decision biases. To paraphrase Thoreau, Strategic Planning looks at lots of things but doesn’t see what really matters for Customer and Organization Value Creation (see here and here ).

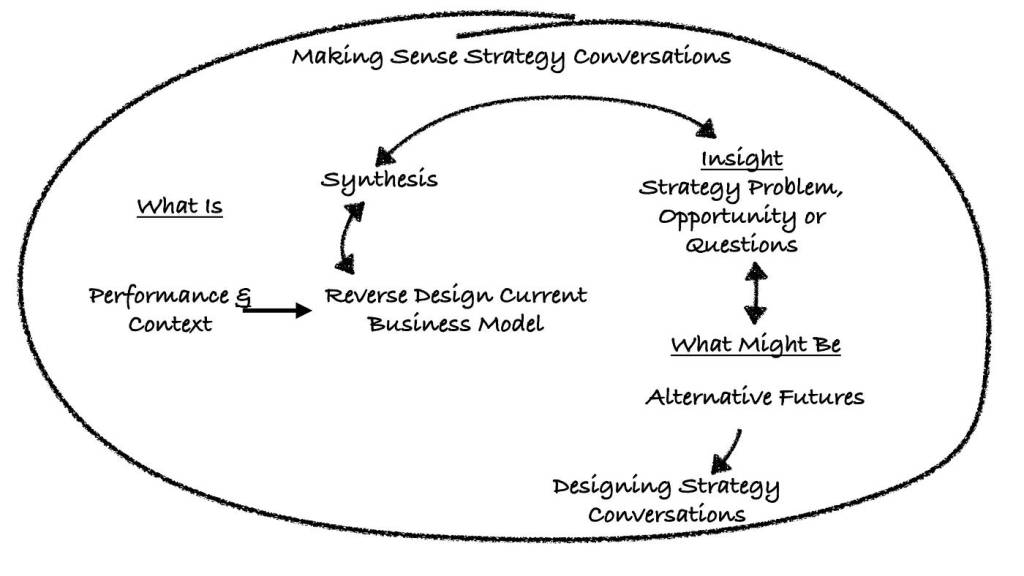

Is there a better way? Yes — Strategy Conversations in Practice (SCIP). In SCIP, aMaking Sense Strategy Conversation is the first in a learning loop of four distinct but interconnected, iterative, and reflective ‘Conversations’. The Business Model View sits at the core of the loop, as a touchstone for each Conversation and the collective output of all four Conversations.

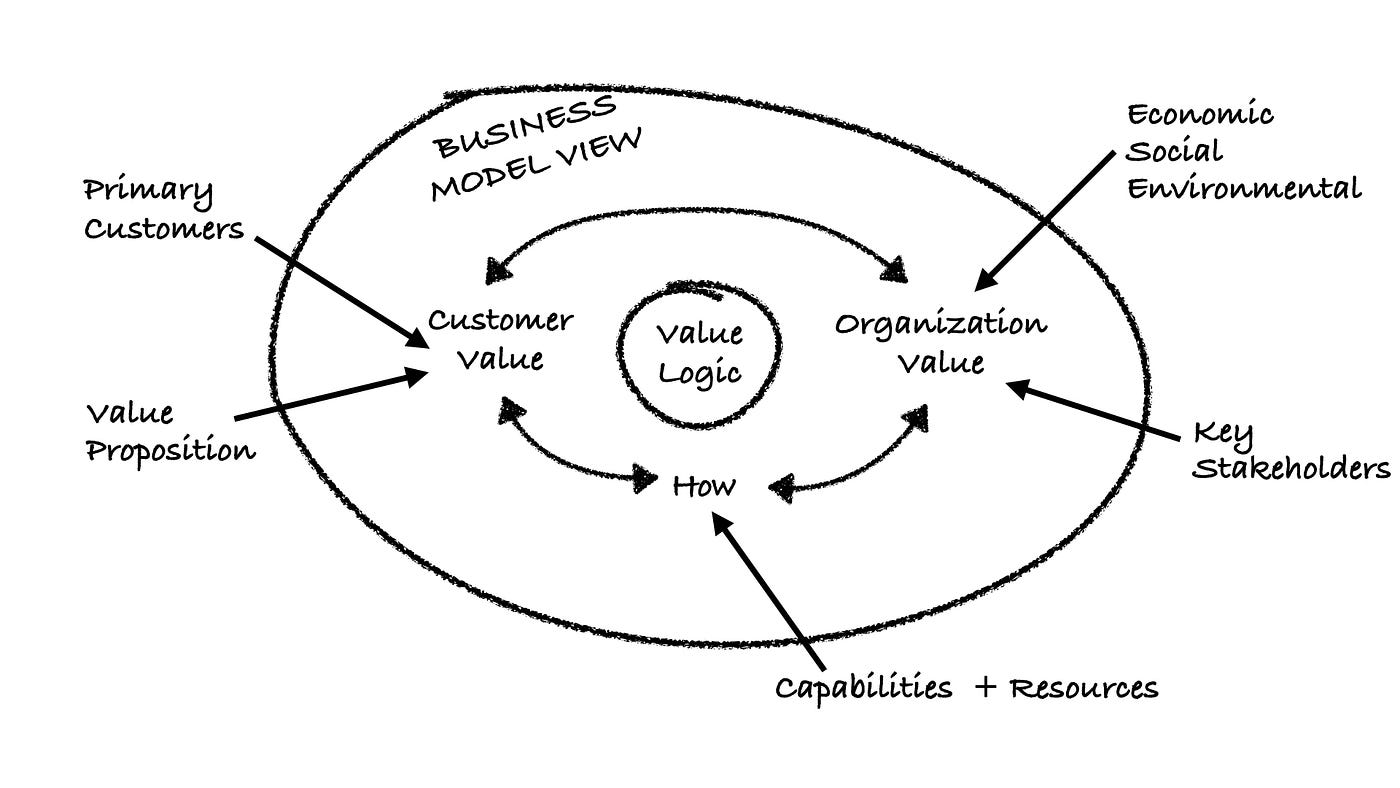

In SCIP I define Business Strategy as the system or pattern realized in the choices — what to do, what not to do — an organization makes in creating value for its Customers, for itself and for its stakeholder. I use the Business Model View to describe this system or pattern.

Making Sense Strategy Conversations focus on using this Business Model View to describe the Value Creation choices a firm has already made— it’s existing or What Is Strategy — and to develop what these choices might look like in the future — it’s What Might Be Strategy. Insight into what really matters for Value Creation is critical in the ‘What Is’ stage while insight and creativity are critical in the ‘What Might Be’ stage.

Making Sense Strategy Conversations focus on using this Business Model View to describe the Value Creation choices a firm has already made— it’s existing or What Is Strategy — and to develop what these choices might look like in the future — it’s What Might Be Strategy. Insight into what really matters for Value Creation is critical in the ‘What Is’ stage while insight and creativity are critical in the ‘What Might Be’ stage

‘What Is’ — the Existing Strategy

Step 1 in describing ‘What Is’ involves understanding a firm’s performance and context. What are the firm’s performance expectations in terms of creating Customer and Organization Value and is it meeting those expectations? How does the firm’s context, its industry, markets and/or competitors affect its ability to meet those expectations?

The selective use of some of the analytical tools of Strategic Management is important in Step 1. I say ‘selective’ to distinguish Step 1 from the preparatory work in Strategic Planning which often takes weeks or months. In a Making Sense Conversation, Step 1 should only take a day or two.

Step 2 in describing ‘What Is’ involves understanding the Business Model choices that underpin those expectations and how those choices affect the firm’s ability to meet performance expectations? Step 2 involves the use of Strategy as Design concepts (see here) to reverse design the existing Business Model. Step 3 involves synthesizing the information from 1 and 2 to gain insight into the unique strategy opportunity, problem or question the firm faces.

Reverse designing a Business Model in SCIP is analgous to reverse engineering in that it involves ‘deconstructing’ the firm’s existing strategy and then ‘reconstructing’ it using the Business Model View as the framework.

‘Deconstructing’ a firm’s existing strategy focuses on its actions (what it does and doesn’t do now) not its plans. The process groups these actions into Customer Value Creation, Organization Value Creation, and How the Value is created. The ‘deconstructing’ steps have been covered in detail in earlier Posts in the Strategy Conversations in Practice (SCIP) series (refer to here, here, here, and here ).

Typically, the questions asked at this stage might include:

Who are our Primary Customers ? What is their Job to be Done?Why do they buy our product or service? Which Customer Value dimensions do we excel in? Which dimensions do we meet table stakes in? Which dimensions do we not even bother about? How do our excel, table stakes, and not bother dimensions of Customer Value compare to competitive offerings?

Who are our current stakeholders? What dimensions of Organization Value — Economic, Social and Environmental — are important to them? Why? Which of these dimensions do we excel in, meet table stakes in, not bother about?

How do we create these dimensions of Customer and Organization Value? What are the Capabilities and Resources that we excel in, that we meet table stakes in, and that we ignore?

‘Reconstructing’ a firm’s strategy involves visually combining these components, usually on a big whiteboard, into a holistic Business Model specific to the firm. Whenever I’ve gone through the ‘reconstruction’ process with firms or watched others do it for the first time in Executive Education classes , the ‘reconstructed’ Business Model often looks more like spaghetti thrown at the whiteboard than a Business Model. That’s OK. This is where synthesis comes in.

Synthesis is About Asking Better Questions

Step 3, the process of ‘synthesis’ in Making Sense Strategy Conversations iterates between questions and ‘reconstruction’ until Business Model clarity starts to emerge from the ‘spaghetti’. Synthesis involves developing hypotheses for the Value Logic that underpins this Business Model and testing the choices made within each component of the Model for focus, coherence and integration relative to this Value Logic ( see here ).

Focus — Do we excel in one clear and dominant Value Logic? What is it? Is it supported by table stakes performance in the other two Value Logics? Are we following it consistently? If not, where are we falling down and why? Are we stuck in the Zone of Mediocrity? Why? What can we stop doing?

Coherence: Is there a logical, consistent and concise cause and effect pathway from what the firm does (How) to the Customer and Organization Value it creates. Is this pathway consistent with the Value Logic? Are there activities that we can stop doing?

Integration: Do all the components fit together into a mutually reinforcing system of Value Creation? Are there activities that are not integrated? What can we stop doing?

Two other questions round out the synthesis stage.

What external circumstances (economic, technology, culture, health, industry, regulatory, competitors etc) are likely to change in the future. What are the implications for our current Business Model?

Are Customer and Organization Value expectations likely to change in the future? Why and in what way? What are the implications for our current Business Model?

The findings from these questions are then abstracted up to identify the major strategy problem, opportunity or question the firm faces. This is where insight is critical. Insight is a skill. Steps 2 and 3 are iterative and often messy. The more times you go back and forth between them the better will be your insight.

‘What Might Be’ Strategy

Creating Alternative Futures is very different to trying to predict the future

The final step in Making Sense Strategy Conversations involves drawing on the concepts and tools of Strategy as Innovation to imagine a firm’s ‘Alternative Futures’ in which the problem, opportunity or question is resolved. An ‘Alternative Future’ is not a fluffy Vision or Mission statement. Nor is it a goal or an objective. Rather, it’s a different way to see the firm, one that can be framed in terms of Business Model choices.

For example, way back in 2010 Dominos Pizza in Australia saw a ‘Digital Future’ for the business and started to invest in technology aimed at easier ordering , delivery tracking, faster make and delivery times for Customers and lower operating costs for the organization itself (see the Post Doing Everything Is Not Strategy). They started slowly but by 2013 the results were so strong that the CEO, Don Meij, excitedly announced that Dominos had moved from a pizza business to an online digital business that sells pizzas……..we are best in class for digital sales, marketing and execution……..

Maybe he was being a little over the top but there is no doubt that insight proved to be a game changer for the Dominos business in Australia.

Interestingly, in a 2022 interview about the turnaround efforts currently underway in Pizza Hut Australia, the CEO at the time said that his main focus has been reshaping what was a restaurant-based operation into a delivery business by using digital technology. A little late??

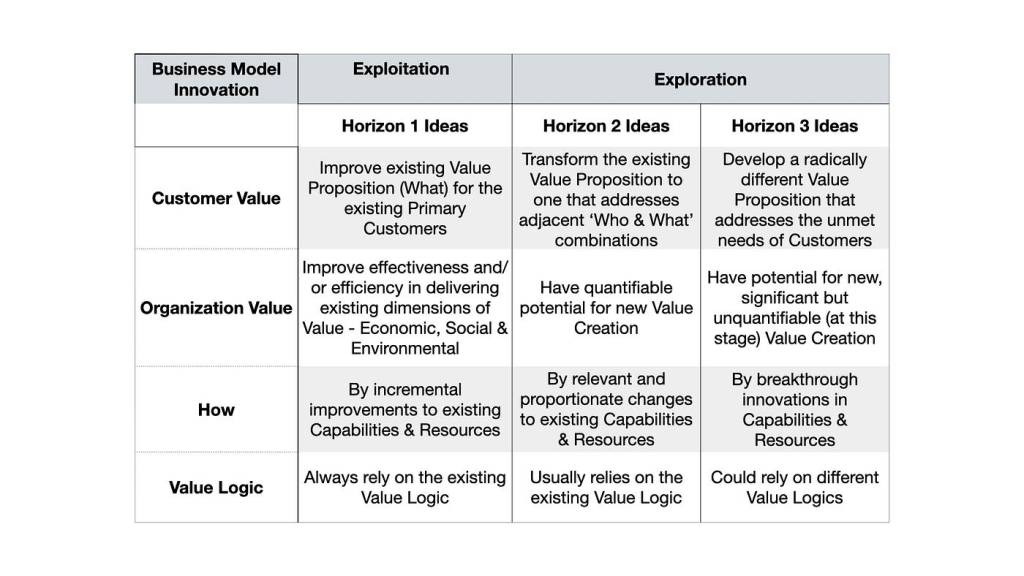

Strategy as Innovation starts with the reverse designed Business Model and then searches for ways to ‘Exploit’ that Business Model and ‘Explore’ new Business Models simultaneously.

Exploitation focuses on continuously enhancing the current Business Model, on refreshing the current Value Proposition and improving ‘How’ to deliver that Value Proposition.

‘Exploration’ focuses on discovering and validating adjacent and/or completely new Customers, their Jobs to be Done, alternative Value Propositions, and new Business Model discovery, iterative testing and subsequent scale up.

This process of Exploitation and Exploration is typically called Business Model Innovation. It relies on a number of creative thinking tools, too many to discuss in this Post (there will be a future Post on this topic) but two excellent books on the subject stand out — Business Model Generation (Alex Osterwalder and Yves Pigneur) and Seizing The White Space: Business Model Innovation For Growth and Renewal (Mark Johnson).

A major problem firms often run into when trying to develop ‘Alternative Futures’ is that they end up with another ‘laundry list’ of ideas that may not fit with the Value Logic of the existing business and may not have natural owners within the existing business. SCIP uses a modified version of the 3 Horizons of Growth developed by McKinsey in 2000 to make sense of these ideas, to translate them into a portfolio of Alternative Futures described in terms of Business Model choices. This portfolio is the output of Making Sense Strategy Conversations. It’s important for two main reasons.

First, identifying a portfolio in this way enables the ideas to be screened, prioritized and management responsibilities allocated. Horizon 1 ideas are an extension of the existing business. They should be relatively simple to validate and implement and provide a clear and quick boost to performance. Horizon 1 ideas should always be the province of existing managers.

Horizon 2 ideas leverage the existing business but go a step further into new ‘Who & What’ Value Creation combinations. They explore emerging opportunities that leverage Horizon 1, follow an iterative development path and have the potential to drive a step change in performance. Horizon 2 ideas may be the province of existing managers or may involve specialist project teams outside the existing business. Regardless, successful Horizon 2 ideas always move into the existing (Horizon 1) business in time.

Horizon 3 ideas usually require a leap of faith in their potential and follow a slow, iterative and messy (think Newman’s Design Squiggle) development path. They should always be the province of specialist project teams (or business units) operating outside the existing business.

As a rule of thumb and provided there are no ‘burning platform’ issues with the existing business, Horizon 1 ideas should occupy 70% of the time and effort in a Making Sense Strategy Conversation, with 20% devoted to Horizon 2 and 10% to Horizon 3.

Second, Horizons 1, 2 and 3 ideas in the portfolio must be progressed in parallel, not sequentially. Rapid advances in technology, especially digital, mean that the development time for Business Model Innovation has shortened considerably. When you add in increasing competition, it becomes clear that firms need a view across all three Horizons contemporaneously and a sense of urgency around continuously creating their own future.

Let’s take a brief look at how a Making Sense Conversation can be retrospectively applied to Bunnings’ Business Strategy over recent years. Bunnings is the Australian equivalent of Home Depot. It is a large ($A18 bill revenue) and very profitable ($A2.2 bill earnings) business unit of Wesfarmers. The first Bunnings ‘big box’ store opened in 1995. Its Value Logic was and still is Operations Leadership and its Customer Value Proposition ‘Lowest Prices, Widest Range, Best Experience’.

Between 1995 and 2023 Bunnings sales and earnings grew at around 15% CAGR and 18% CAGR respectively. The key insight that ignited this growth and has underpinned it ever since was the realization that Bunnings had opportunities in what they call ‘Addressable Markets’ (adjacent markets in the Three Horizons model) outside the traditional hardware market. Bunnings Business Strategy has been to progressively expand into carefully selected segments of these ‘Addressable Markets’ by leveraging the existing Business Model. Most of these Horizon 2 ideas were rolled out in the existing stores and, by virtue of the increased volume, contributed to improved effectiveness and efficiency in those stores, a Horizon 1 effect.

Bunnings ‘Addressable Markets’ show a progression from traditional hardware to Home Improvement, to Home Improvement and Outdoor Living, to Home and Lifestyle + Commercial, to Interconnected Home and Lifestlye + Commercial. Within each of these markets sub-segments were identified and products or services launched.

A recent example of a Lifestyle subsegment is Pet Care. Pet ownership in Australia exploded during the pandemic. Given this opportunity, Bunnings are slowly rolling out their biggest ever new category with up to 1000 Pet Care products to be added to the range.

Bunnings has also implemented a number of Horizon 2 ideas aimed at moving from a part-time focus on ‘tradies’ as Customers within their consumer-oriented stores to dedicated ‘tradie’ offerings. A recent example was the acquisition of Tool Kit Depot, a small, localised group of stores that retail and hire high-end power tools, specialised woodworking equipment and other commercial grade products. Tool Kit Depot’s Business Model is related to Bunnings core business, but it is also very different in terms of the product range, knowledge and service that are essential in this market segment. For Bunnings it’s an ‘emerging’ Business Model that will be scaled up and expanded geographically but managed as a separate business unit while management ‘learns’ how it works.

Making Sense Strategy Conversations set the overall direction for the firm so they should be the province of senior managers and board directors. They are not a once p.a. exercise and they’re not part of the budget cycle. Rather, Making Sense Conversations should happen when there are signs that Customer Value and/or Organization Value expectations are not being met, when there are unexpected changes in a firm’s environment, when the conditions for success (Roger Martin’s What Would Have To Be True) of the Business Strategy are in doubt or don’t eventuate. The timing of Making Sense Strategy Conversations is a judgment call, not a calendar call.

Making Sense Strategy Conversations are not linear. The arrows go one way in the visual for simplicity of presentation. But the reality is that Making Sense Strategy Conversations involve an iterative and messy process. However, the more you practice them, the better your insight becomes. And the better your insight becomes, the more likely you are to develop a creative strategy that will set your firm apart from the crowd (who are stuck in Strategic Planning mode).

Finally, at their core, Making Sense Strategy Conversations are ‘damn good arguments’ (vigorous but constructive debate to be more polite), seen through the Business Model View, about a firm’s existing Strategy and what changes need to be made for Better Strategy.

Questions or comments are welcome. That’s what Strategy Conversations are all about.

Leave a comment