Who, What and Why of Customer Value Part II

We want this! And that! We demand a share in that, and most of that, some of this, and f**king all of that! Less of that, and more of this, and f**king plenty of this! And another thing, we want it now! I want it yesterday, I want f**king more tomorrow, and the demands will all be changed then so f**king stay awake!

Sir Billy Connolly, Scottish Comedian

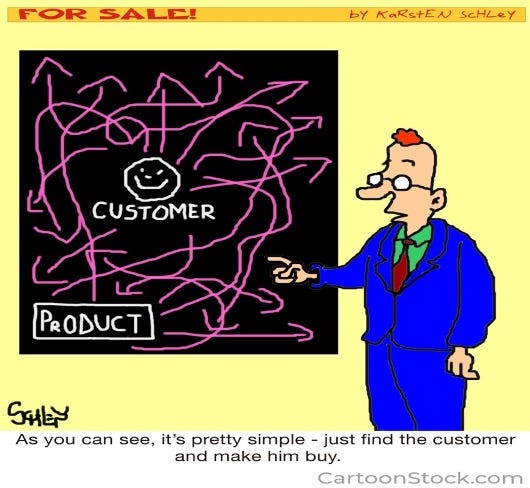

Have you ever seen Billy Connolly’s video on Demands? It reminds me of some of the Customers I dealt with in my corporate life. And it especially reminds me many of the Strategic Plans I’ve seen. ‘Laundry lists’ of ‘this and that’ objectives and fragmented threads of activity, typically called strategies, intended to achieve them. The attention is on internal activities and measures, especially costs, but they’re only integrated on paper. There are loads of KPIs. They’re not integrated either, and they make as much sense as Billy’s demands. The Plan says a great deal about the business but very little about really matters. Instead, everything is important. And critically, the pathway to Customer Value Creation is buried somewhere deep in the mix. The problem:

Businesses don’t know as much about their Customers as they think they do

The Strategy Conversations In Practice (SCIP) framework follows a different approach. SCIP is grounded in the principle that firms must first create Customer Value before they can share in that value. SCIP recognizes that different Customers buy different dimensions of value and that it is impossible for firms to offer the best in all value dimensions. In SCIP firms choose their Customers carefully and choose to provide those Customers with the best offering in only some dimensions of value; they choose to meet competitive parity or threshold expectations (table stakes) in other dimensions of value, and they choose to ignore still other dimensions of value.

In existing firms, SCIP starts with understanding the firm’s current Customer Value offering in terms of ‘Who, What and Why’. I talked about ‘Who’ in my prior Post, Being Customer Centric Is Not Strategy. In this Post, I’ll focus on the ‘What and Why’ of Customer Value. I’ll also talk about integrating ‘What and Why’ into a clear and compelling Value Proposition that guides Business Strategy.

I emphasize that, while I’m separating ‘Who, What and Why’ for the purposes of writing bite-size Posts, in practice, these choices must always be considered together.

What and Why Customers Buy — Jobs to be Done

The customer rarely buys what the company thinks it sells him.

This is one of those great Peter Drucker quotes that has stood the test of time. Clayton Christensen recognized this situation in developing his Jobs to be Done theory . Christensen argued that firms might know a lot about Customer demographics and characteristics but that these provide little insight into why Customers buy. Christensen also argued that Customers ‘hire’ products or services to do ‘Jobs’ for them and that understanding those ‘Jobs’ provides insight not only into what and why they buy but also into how to make a firm’s innovation efforts more successful.

As a simple example of this ‘Jobs’ concept, consider Ted Levitt’s famous quote about a customer who wants to buy a drill bit.

People don’t want a quarter-inch drill, they want a quarter-inch hole.

The ’What’ (Job to be Done) is a hole in the wall and the ‘Why’ is most likely to hang a picture. But you could argue that this ‘What and Why’ has changed over the years. A more nuanced perspective today could be that their Job to be Done is hanging an object without marking the wall at all. The point is, a Customer’s Job to be Done is always context dependent. Just as the ‘Who’ of Customer Value is not static so too is the ‘What and Why’.

While this is a good example it’s important to recognize that Jobs to be Done are rarely just about function. They can have, in Christensen’s words, ‘powerful social and emotional dimensions’. Understanding ‘Jobs’ requires that they be unpacked into their different Value Dimensions.

Unpacking Jobs to be Done — Value Dimensions

One frequently used approach to understanding the ‘What and Why’ of value creation is to ask Customers, usually in focus groups and/or some form of quantitative survey, why they purchase a certain product or service. However, these are blunt approaches that provide limited insight into Customers’ problems and potential solutions. A quote that is often wrongly attributed to Henry Ford is:

If I had asked people what they wanted, they would have said faster horses.

Regardless of whether Ford said it or not, the point is valid. Customers might know what their problem is but their perceived solutions are often framed ‘within’ rather than ‘outside’ the box, limiting the potential for innovation.

A better approach to understanding ‘What and Why’ Customers buy is to get much closer to Customers by conducting one-on-one, semi-structured interviews asking each Customer questions such as “what are you trying to do and why, how do you currently do this, what frustrates you, and what might be better?” The aim is to establish a more granular understanding of a Customer’s Job to be Done by using generic Customer Value categories to explore the relevance and application of different dimensions of value to that Job.

In B2C markets I use five generic Customer Value categories as a preliminary framework to better understand a Customer’s Job to be Done:

- Cost: Asking price and all the other elements of cost that Customers may incur e.g. convenience, warranty, availability, repairs, maintenance.

- Utility: Performance of specific tasks e.g. taste, ease of use, speed.

- Social: Being perceived in a favourable way by others e.g. status, brand image or contributing to broader societal value e.g. community support, environmental effects (or lack of).

- Personal: Achieving a specific individual goal e.g. title, financial security.

- Engagement: Customer experience in the context of purchasing and consuming e.g. service, co-creation of value.

Generic Customer Value categories can also be identified for B2B markets:

- Compliance: With regulatory or voluntary standards, with product or service specifications, with community expectations.

- Utility: Performance of specific tasks, productivity gains, cost reductions.

- Ease of Doing Business: Improved access to resources, better supply chain management, risk reduction.

- People: Knowledge and skills, career development, networks, health and lifestyle benefits.

- Purpose: Environmental, Social, and Governance expectations.

In identifying Value Dimensions it is important not to use constructs. For example, value for money is a construct of dimensions such as price, payment terms, warranties, delivery fees etc. Insights come form unpacking Customer Value categories, not re-bundling them.

Nothing beats talking to actual Customers.

To unpack Customers’ Value Dimensions, it’s critical that strategists themselves talk to actual (or potential) Customers in the first instance. Commissioning market researchers may come in later, but strategists must first get close to Customers. I cannot emphasise this point enough. There has been a lot written about ‘talking to Customers’ but if you want a good starting point, read Tim Kastelle’s Post — The How and Why of Customer Development.

Another way to get close to Customers is to observe them making purchasing decisions and using products or services in their ’natural habitat’. Again there has been a lot written about this subject but a good place to start is Christian Madsbjerg’s Harvard Business Review article An Anthropologist Walks into a Bar .

Integrating What and Why into a Value Proposition

A clear, concise and compelling Value Proposition is critical in Business Strategy. Why? Because it guides Business Model choices on what to do, and what not to do in creating value for Customers, for the organization itself and for its stakeholders. In articulating a firm’s Value Proposition, it is important to avoid the temptation, especially in B2C markets, to lapse into ‘advertising speak’ hyperbole. This does not help Business Model design.

Avoid the glittering generalities, the fluff and the hyperbole.

Why? First, everyone within the firm needs to understand what activities really matter for Customer Value creation — where to excel, where to meet threshold expectations, where to not even bother — and the links between the choices they routinely make each day and these activities. A fluffy Value Proposition risks subjective interpretations which can lead to sub-optimal resource allocation and conflicting activities rather than coherent and integrated Business Model choices.

For a good example look at the Post on Who Gives A Crap. The Value Proposition in ‘advertising speak’ is ‘Good for your bum. Great for the world’. My take on it as a Strategist is: Toilet paper that is guaranteed to make you feel good or your money back — it’s environmentally friendly and at the same time, soft and comfy, with colorful and quirky packaging, an irreverent sense of humor, reliably supplied direct to the home and most importantly, it builds toilets and improves water safety for people in need’. Which version do you think will better guide Business Model design?

Second, a clear and concise Value Proposition determines the dominant Value Logic that should underpin a firm’s Business Model. A fluffy Value Proposition means a fluffy Value Logic, which leads to problems in saying no. That’s when Business Strategy defaults to a laundry list of loosely related activities where direction is vague, people try to excel at everything and end up excelling at nothing. It’s a recipe for mediocrity at best.

From Customer Value to Business Model Choices to Better Results — Dominos Pizza Australia

………from a pizza business to an online digital business that sells pizzas……..we are best in class for digital sales, marketing and execution……..

Don Meij, the long serving Dominos CEO made this comment in the 2013 Annual Report. It still holds true today. A little bit of background information will help in understanding it’s relevance to this discussion about Customer Value.

A major Customer segment for Dominos is families with school age children. My take on their Job to be Done is ‘a freshly cooked meal for the whole family that is a special treat, available quickly and easily at a low price’.

Dominos doesn’t claim to provide the best tasting takeaway/home delivery pizza in Australia. For Dominos, taste is a ‘table stakes’ value dimension. So too are dimensions such as range and sides (drinks & desserts). Dominos Value Proposition, where it chooses to excel, is ‘a hotter, fresher pizza, at a low price’. The dominant Value Logic underpinning Dominos Business Model has always been Operations Leadership (see the Post An Unbalanced Value Logic is the Key to Better Business Strategy).

But things were different in 2010. The industry standard delivery time for a pizza was 45 minutes. Not surprisingly ‘hot and fresh’ was a promise that was often not met. That year, Dominos recognized the potential for digital technology to (1) improve on the ‘cost’ and ‘utility’ value offerings to Customers by enabling easier ordering and delivery tracking along with faster make and delivery times; and (2) lower operating costs.

Dominos invested in digital capabilities and the effect was so quick and so spectacular that Don Meij made his excited comment in 2013 about the transformation in the business.

Fast forward to the 2023 Annual Report where Don Meij talks about two key components to Dominos strategy — opening more stores closer to Customers, and digital technology — both of which are key enablers of the ‘hotter, fresher’ Value Proposition. These insights have proven to be game changers in the takeaway & home delivery pizza market. They enabled a virtuous cycle of growth in sales volume, franchise outlets, revenue and profits for Dominos with results that were unheard of in the pizza industry beforehand.

Pizza Hut is still struggling to catch up more than ten years later. In a 2022 interview about the turnaround efforts currently underway in Pizza Hut Australia, the CEO said that his “main focus has been reshaping what was a restaurant-based operation into a delivery business by using digital technology.”

Summary: Strategy Conversations In Practice recognize that Customers buy products or services to address a Job that they want done or a Problem that they want solved. Firms need to clearly understand this Job or Problem in terms of its discrete Value Dimensions, and choose which Dimensions it will address, where it will excel, where it will deliver competitive parity or threshold standards, and where it will not even bother. These choices should be integrated into a clear and compelling Customer Value Proposition, one that is expressed in concise and unambiguous terms that everyone within the organization can understand and use to guide the choices they make in their everyday activities — what to do, what not to do.

Question: What is the Job to be Done for your firm’s Customers? What insights does this understanding enable? What gaps or problems are there in the current Strategy?

Leave a reply to Want Better Strategy? Start With Making Sense Strategy Conversations – Strategy Conversations In Practice Cancel reply