Businesses have rarely approached societal issues from a value perspective but have treated them as peripheral issues.

Michael Porter and Mark Kramer in Creating Shared Value 2011

Balancing and integrating choices on Customer Value and Organizational Value is like running along a barbed wire fence with one foot on either side……it’s not very comfortable.

With apologies to Joh Bjelke-Petersen, a former Australian politician

Joh Bjelke-Petersen, a former and eccentric (and that’s putting it very mildly) State Premier in Australia once described his job as like running along a barbed wire fence with a foot on either side……. it’s not very comfortable…… It’s an apt way to describe the strategy choices that need to be made in balancing Organization and Customer Value Creation.

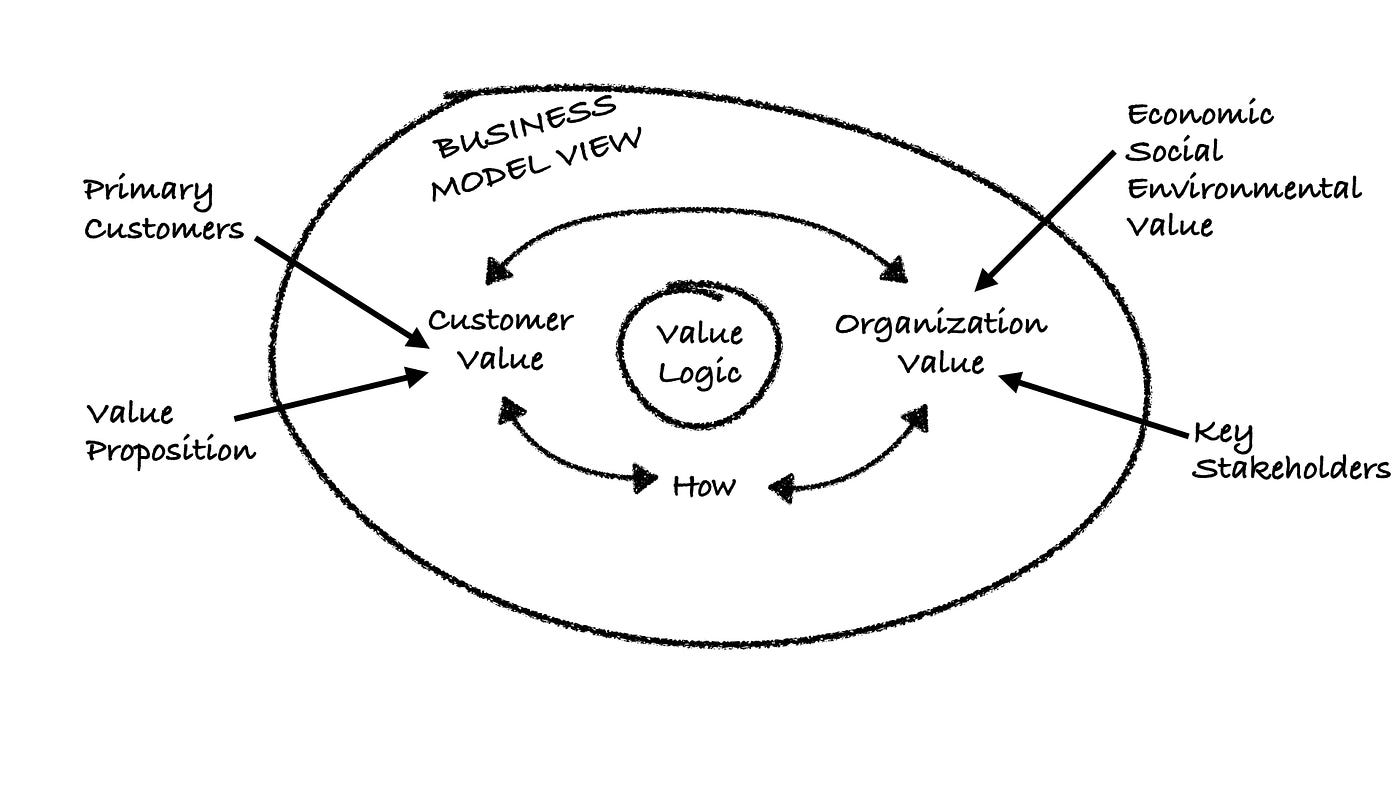

In Strategy Conversations In Practice (SCIP) I define Organization Value as the benefits that accrue to a firm itself and its stakeholders from creating Value for its Customers. Organization Value has three interdependent dimensions — Economic Value, Social Value and Environmental Value.

Most firms have considerable discretion when it comes to choices about the ‘Who, What and Why’ of Customer Value (see the Posts Being Customer Centric Is Not Strategy and Doing Everything Is Not Strategy). However, when it comes to choices about Organizational Value, this discretion is complicated, especially in large firms, by competing expectations of multiple stakeholders such as employees, suppliers, communities, environments, and shareholders. Firms must make choices that are integrated and balanced relative to these stakeholder expectations. The higher and more diverse the expectations (the metaphorical barbed wire fence), the more difficult the choices.

Michael Porter and Mark Kramer posed the concept of shared value creationas a way to integrate competing expectations in a 2011 Harvard Business Review article. It involves making choices that simultaneously connect and improve firm economic performance and societal progress. It’s a principle that has gained considerable traction over the last 12 years.

Boards and management teams are looking more closely at social and environmental issues that have specific relevance to their firms’ economic performance. And there is increasing support for the argument that, to move these social and environmental issues from the periphery to the core, they must be woven into a firm’s Business Strategy and contribute to Customer Value Creation as well as improve overall firm performance.

ESG Activities………Woke Capitalism? Virtue Signalling?

This aim has been partially addressed by the investment community in recent years using ESG data (Environmental, Social and Governance). While the ESG movement has its critics — some call it naïve, a version of ‘woke capitalism’ — it also has its cheerleaders. Many investors now incorporate ESG data into their fundamental analyses. Activist investors use ESG data to encourage changes in strategy in the firms they’re invested in.

However, I argue that ESG scores have limited utility to Business Strategy practitioners. Why? First, ESG scores are subjective constructs derived by external parties using a range of inconsistent methodologies. While these scores may provide a small window into a firm’s Environmental and Social performance, it’s still a view from the sidelines. In many cases the focus is more on reporting, on ‘virtue signaling’ than on real value creation. In particular, the link between ESG scores and firm economic performance remains to be established.

Second, and more importantly, ESG scores don’t provide a logic for integrating the complexity in choices and for balancing the inevitable trade-offs that strategy practitioners routinely face in today’s organizations.

Strategic Planning ………..A Longer Laundry List

To go a step further, I argue that the main hurdle to integrating the management of social and environmental issues into Business Strategy is not so much the limitations of ESG scores but rather the fact that many firms are still stuck in the Strategic Planning paradigm. Strategic Planning, with its linear process, its internal focus, its predilection for setting fragmented objectives and loosely related threads of activity to achieve those objectives, doesn’t have a mechanism to integrate complex and interdependent choices about Customer, Economic, Social and Environmental Value.

Instead, Strategic Planning just adds Social and Environmental considerations to its ‘laundry list’, a few more things to do which means it is more likely to further entrench the ‘peripheral issues’ problem that Porter and Kramer identified back in 2011. Firms that rely on Strategic Planning to address social and environmental issues are more likely to default to ‘box ticking’ than to make integrated and balanced choices that simultaneously drive both Customer and all three dimensions of Organization Value Creation in a manner that is proportionate to the firm’s context.

Doing Well and Doing Good — Business Model View

The Business Model View at the centre of SCIP provides an ideal framework to balance and integrate choices about Customer Value Creation and all three dimensions of Organization Value Creation into a holistic Business Strategy. Why? Two reasons.

First, the same ‘Who, What and Why’ questions that are applied to Customer Value can also be applied to the dimensions of Organization Value. More specifically, who are the relevant stakeholders? What dimensions of Economic, Social and Environmental Value really matter to these stakeholders. What are their expectations in terms of the levels of value for each dimension? What choices will the organization make as a result — which dimensions of Social and Environmental Value will it aim to excel in, which will it aim to meet competitive or table stakes expectations in, and which will it not even bother about?

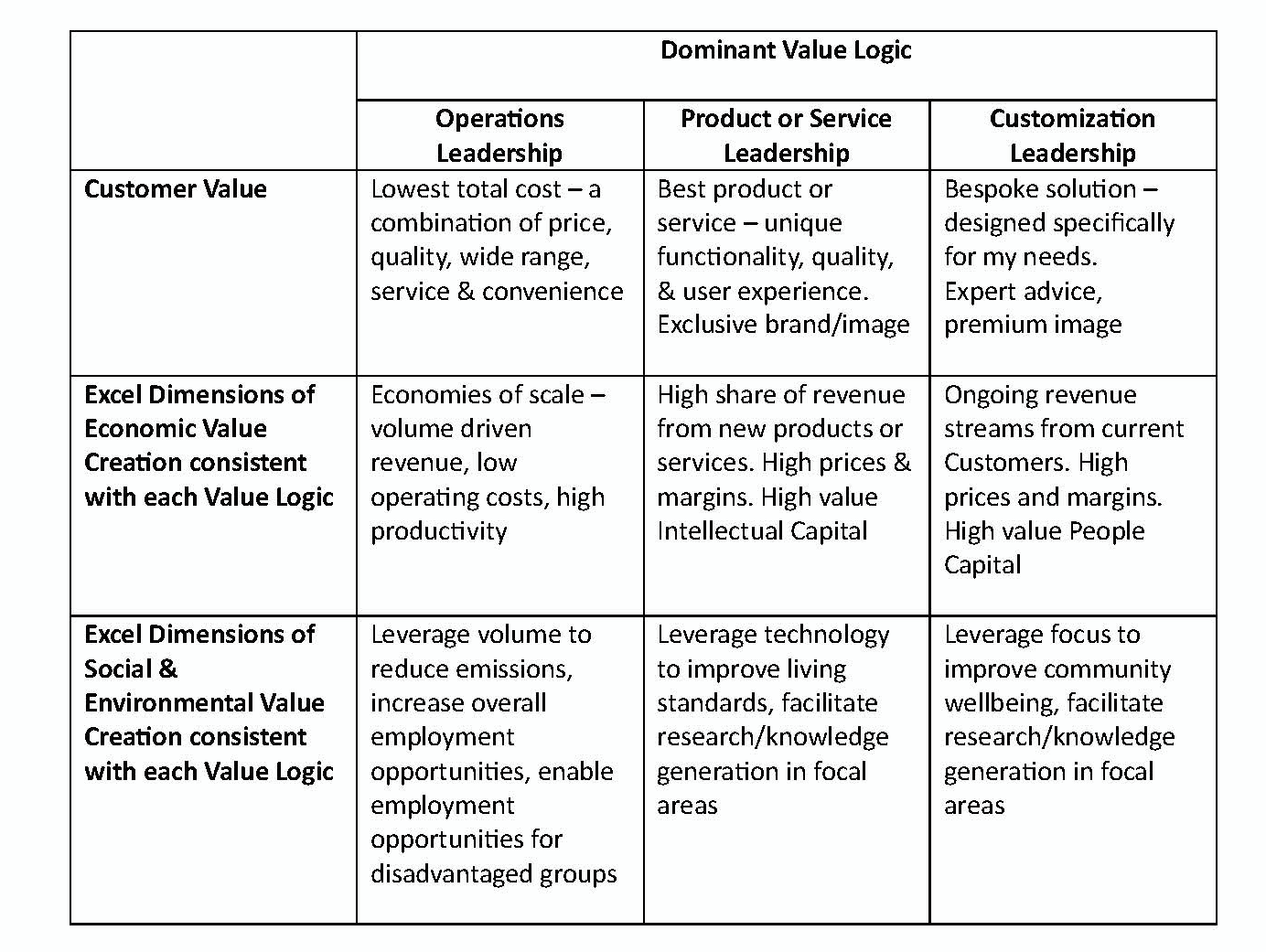

Second, when it comes to balancing and integrating Economic, Social and Environmental Value Creation choices, the key to simultaneously moving them into the core of Business Strategy is to ensure that they’re consistent with and leverage the dominant Value Logic underpinning Customer Value Creation (see the Post An Unbalanced Value Logic Is the Key to Better Business Strategy).

This argument is best understood by looking at some examples for each Value Logic.

There are numerous opportunities for firms with Operations Leadership as their dominant Value Logic to weave Customer and firm Economic Value Creation together with Environmental and Social Value Creation. Consider Wal-Mart and Amazon. By leveraging volume to reduce packaging components and optimize distribution facilities and delivery routes, costs can be lowered. This creates Economic Value for the firm while at the same time lowering carbon emissions.

Domino’s Pizza in Australia is another example of the Operations Leadership Value Logic in action to create Environmental and Social Value. Domino’s Environmental Value Creation efforts are focused on stores and operations, the food served and the way that food is produced. Not surprisingly, Domino’s aims to reduce emissions by expanding the use of electric vehicles and optimising its store network. But Domino’s is also working with the dairy industry to reduce one of the largest sources of emissions in pizza production — cheese — without compromising on Customers’ taste preferences.

STREAT, an Australian social enterprise operating in the hospitality industry, has successfully integrated Economic and Social Value creation into its dominant Operations Leadership Value Logic. STREAT operates street front cafes, corporate cafes (inside corporate offices), a catering business and a specialty coffee beans business. These businesses provide an opportunity for employment of homeless and disadvantaged youths and fund vocational (hospitality industry) and life skills training plus specialty support services for these youths. STREAT’s Customer, Economic and Social Value Creation is best summed up by their own numbers:

Four million ‘conscious consumers’ have enjoyed the delicious fare from our 12 social enterprises and enabled us to provide over 3100 amazing young people with a safe space to belong and over 240,000 hours of support and training as their recipe for building a healthy life.

CSL is a global biotechnology leader with its headquarters in Australia and a listing on the Australian Securities Exchange. The dominant Value Logic in CSL is Product Leadership. The firm has chosen to excel in innovative, plasma derived protein therapeutics for immunology, haematology, cardiovascular, metabolic, respiratory and transplant diseases as well as in differentiated vaccine products (primarily influenza). CSL has a secondary, but still important, focus on Operations Leadership in its plasma collections operations.

CSL creates Customer Value by saving and improving lives of patients with diseases in these therapeutic areas and by preventing the spread of influenza in the general population. There is an obvious and very significant flow on to Social Value Creation in terms of improved longevity and quality of life for patients, improved public health, lower hospitalization costs, and lower cost burdens on government. CSL enhances this Social Value Creation by supporting specific patient communities and collaborating with medical and scientific organizations.

CSL creates Environmental Value through responsible and efficient use of natural resources such as water and energy. However, CSL is not targeting zero emissions by 2030 but rather a 40% reduction in emissions based on the 2019 to 2021 levels. The rationale, as outlined by the CFO in the Australian press, is to set goals that “balance its business objectives with what was genuinely achievable”.

Clearly, Environmental Value Creation in CSL is not integrated into its Business Strategy to the same extent as Customer Value and Social Value. Rather, it’s a dimension where CSL chooses to meet acceptable (table stakes) standards. This is not meant to be a criticism of CSL but rather a commonsense reflection of its strategy.

Another good example is Monash IVF Group, an Australian publicly listed company that provides human fertility and assisted reproductive services in Australia and some Southeast Asia markets. Monash IVF’s dominant Value Logic is Customization Leadership. The Value Proposition is to help patients achieve their dream of having a family by providing a range of services from pre-conception health assessments to genetic testing, counselling, fertility treatment options and women’s ultrasound diagnostics tailored to each patient.

Monash IVF creates Economic Value through its fee for services approach. The firm creates Social Value for the broader community by virtue of a flow on effect from conception to happy families, local population growth and subsequent economic growth. Monash IVF also creates Social Value directly via its research activities and its collaboration with the scientific community. In this way the firm contributes to the medical and scientific communities’ knowledge base in reproductive healthcare while at the same time building its own capabilities in delivering patient services.

What about Shareholder Value?

One obvious question that many people ask is where does Shareholder Value Creation fit into Business Strategy? This is a tricky subject, so I’ve devoted the next Post in this series to Maximizing Shareholder Value — A Legitimate Goal of Business Strategy or the Dumbest Idea in the World?

Summary: Businesses are under increasing pressure to better integrate Social and Environmental considerations into their mainstream Customer and Organization Value Creation activities, to do well and do goodsimultaneously. Neither Strategic Planning nor the ESG movement provide an adequate framework for integrating the complex choices involved or for balancing the trade-offs that these choices present to strategy practitioners. But the Business Model View at the core of SCIP provides an ideal framework to address both challenges.

It addresses the three dimensions of Organization Value — Economic, Social and Environmental — with the same ‘Who, What and Why’ questions that are applied to Customer Value. More specifically, who are the relevant stakeholders? What dimensions of Economic, Social and Environmental Value really matter to these stakeholders. What are their expectations in terms of the levels of value for each dimension? What choices will the organization make as a result — where will it aim to excel, to meet competitive or table stakes expectations, and to not even bother?

Plus, the Business Model View balances and integrates Economic, Social and Environmental Value Creation choices by ensuring that they’re consistent with and leverage the dominant Value Logic underpinning the firm’s Customer Value Creation.

Leave a reply to Want Better Strategy? Start With Making Sense Strategy Conversations – Strategy Conversations In Practice Cancel reply