In my first Post in the Strategy Conversations in Practice (SCIP) series I argued that Strategy has lost its way. Rather than providing focused direction, strategy has become over complicated, fragmented, and confusing. The main culprit — Strategic Planning.

While Strategic Planning has become institutionalised in the business world, I agree with Henry Mintzberg. Strategic Planning is an oxymoron. You cannot plan Strategy because planning is primarily about analysis while Strategy is primarily about synthesis, about developing insight into what really matters. I also agree with Roger Martin — a Plan is not a Strategy. A Plan involves programming activities in an organization while a Strategy involves developing a focused, coherent and integrated theory of value creation.

The output of Strategic Planning is typically a ‘laundry list’ of fragmented threads of activity, usually called strategies, that are grounded in an internal perspective of the firm and aimed primarily at creating value for the firm itself rather than for its Customers. Strategic Plans rarely have an overall ‘logic’, an overarching ‘theory of the business’ that integrates these so-called strategies and guides choices and trade-offs between them, what to do and what not to do. Instead, Strategic Plans try to do everything which is, at best, a recipe for mediocrity ( Doing Everything Is Not Strategy).

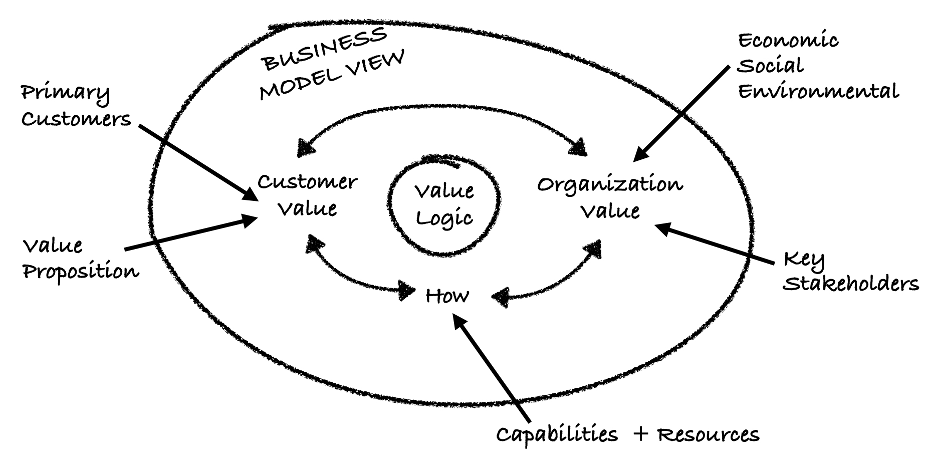

This is where the Business Model View and the Value Logic concept used in SCIP come in. In earlier Posts I’ve covered Customer Value, Organization Value and How each are created but have only touched on the Value Logic concept. The Value Logic at the core of the Business Model View is a generic theory of Strategy as contemporaneous Customer and Organization Value Creation that informs the choices about each component of the Business Model and explains the interdependencies between them.

The Value Logic concept in SCIP is derived from the Value Disciplines described by Michael Treacy and Fred Wiersema in their book, The Discipline of Market Leaders. These authors argued that firms outperform their competitors by carefully choosing their target Customers, and focusing tightly on delivering, at a level their competitors cannot match, the dimensions of value those Customers expect and will pay for. They posed three different ‘Value Disciplines’ as generic theories of value creation.

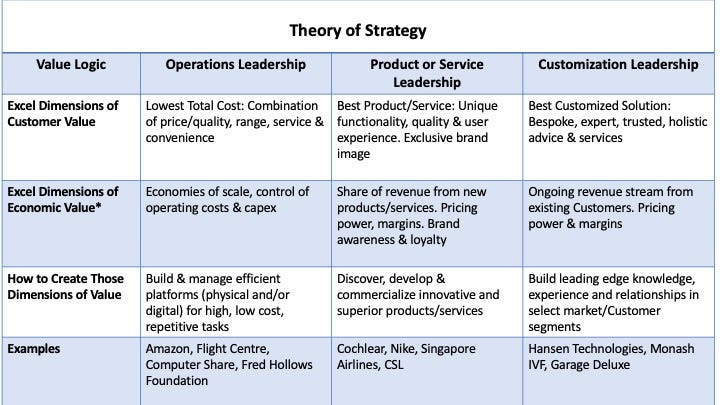

In SCIP, I’ve adapted these ‘Value Disciplines’ and relabelled them as Value Logics — Operations Leadership, Product/Service Leadership, and Customization Leadership (Table). The key premise underlying the Value Logic concepts is that different Customers will prefer different dimensions of Value. In creating these different dimensions of Customer Value, firms will capture different dimensions of Organization Value. Not surprisingly, the How of Value Creation will also be different for each Value Logic.

Implications for Business Model Design

It is important to recognize that, while each Value Logic involves different, albeit generic perspectives on Customer Value, Organization Value and How, Business Model design involves translating these generic perspectives to form a Model that is specific to the firm in question. It is also important to recognize that the three Value Logics are not mutually exclusive.

In practice, these two insights mean that many different Business Models are possible even within the same industry by configuring choices on Value Logic, Customer Value, Organization Value and How differently.

Implications for Value Creation

The potential for a Business Model to create Customer and Organization Value depends on three factors — Focus, Coherence and Integration.

Focus: There must be one Dominant Value Logic in which the firm excels supported by Table Stakes performance in the other two. When a firm chooses its Primary Customers and the Value Proposition to offer those Customers, it automatically sets its Dominant Value Logic which then shapes the other Business Model choices — Organization Value and How. In practice, this plays out as excelling in carefully selected Value Dimensions, meeting either competitive parity or internal standards (Table Stakes) in some other Value Dimensions and ignoring others.

For example, firms whose Dominant Value Logic is Product/Service Leadership or Customization Leadership cannot ignore cost. If their product/service costs rise faster than their ability to raise prices, then margins will be eroded. Thisusually leads to expenditure reductions elsewhere in the business (R&D, capex, people, technology) which often lead to a downward spiral in revenue and profits. One way to protect against this is to maintain a secondary focus on Operations Leadership, to constantly look for ways to take cost out of the business without adversely affecting revenue and/or the firm’s ability to continue to offer a high level of unique functionality or customization value dimensions.

Similarly, firms whose Dominant Value Logic is Operations Leadership cannot ignore product/service innovation. They must be able to meet Table Stakes standards in terms of functionality or they will lose volume.

Coherence: To effectively create Customer and Organization Value, a firm’s Business Model must be coherent. It must demonstrate a cogent, consistent and concise pathway from what the firm does (How) to the Customer and Organization Value it creates. There must be a clear cause and effect model whereby every step is consistent with the Dominant Value Logic.

Integration: To effectively create Customer and Organization Value, a firm’s Business Model must be integrated. The components must all fit together and must be mutually reinforcing. How often do you see organizations that operate in silos? Instead of being integrated, they each go their own way, creating problems within the organization and outside it for their Customers. Banks, airlines and insurance companies are classic examples.

Summary: A firm’s Value Logic is its theory of Strategy as contemporaneous Customer and Organization Value Creation. There are three different, but not mutually exclusive Value Logics — Operations Leadership, Product/Service Leadership and Customization Leadership. Each Value Logic involves different, albeit generic perspectives on Customer Value, Organization Value and How. Business Model design involves translating these generic perspectives to form a Model that is specific to the firm in question. The potential for a Business Model to create Customer and Organization Value depends on three factors: (1) Focus — the Business Model must be based on one clearly dominant Value Logic supported by Table Stakes in one of the other two; (2) Coherence — the Business Model must demonstrate a cogent, consistent and concise pathway from what the firm does (How) to the Customer and Organization Value it creates; and (3) Integration — the components of the Business Model must all fit together and must be mutually reinforcing.

Leave a comment