Understanding a business model requires not only knowing the compositional elements, but also grasping the interdependencies between elements. This is easier to express visually than through words. This is even more true when several elements and relationships are involved.

The world is so full of ambiguity and uncertainty that the design attitude of exploring and prototyping multiple possibilities is most likely to lead to a powerful new business model.

Alexander Osterwalder 2010

What’s wrong in this scene? The aim is for the kid and the dog to have fun. Dogs love to run in the snow, kids love to ride sleds in the snow. All the components are in place………..snow, sled, kid, dog, harness, park…….. The problem is that the scene is not configured correctly. It needs some ‘Design Thinking’. The same is true for strategy.

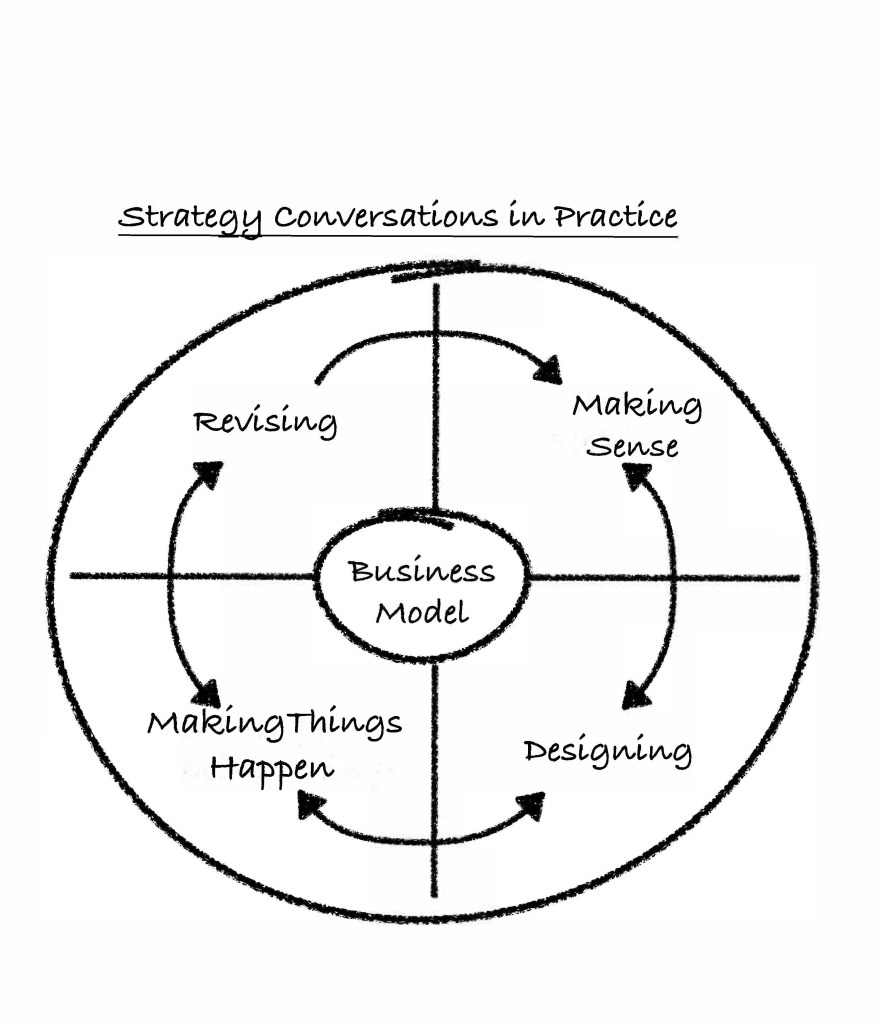

Design Thinking has become something of a fad in the business world in recent years. Not surprisingly, it has various definitions. I see it as a holistic, intuitive, Customer focused approach to creating value. Strategy Conversations in Practice (SCIP) is a design journey covering four stages — Making Sense, Designing, Making Things Happen and Making Revisions. Elements of Design Thinking are important in each stage. The Business Model View at the core of SCIP is the output of applying a Design Thinking lens to Business Strategy, one that involves configuring choices about the ‘Who, Why, What, and How’ of Customer Value and Organization Value Creation into a holistic system.

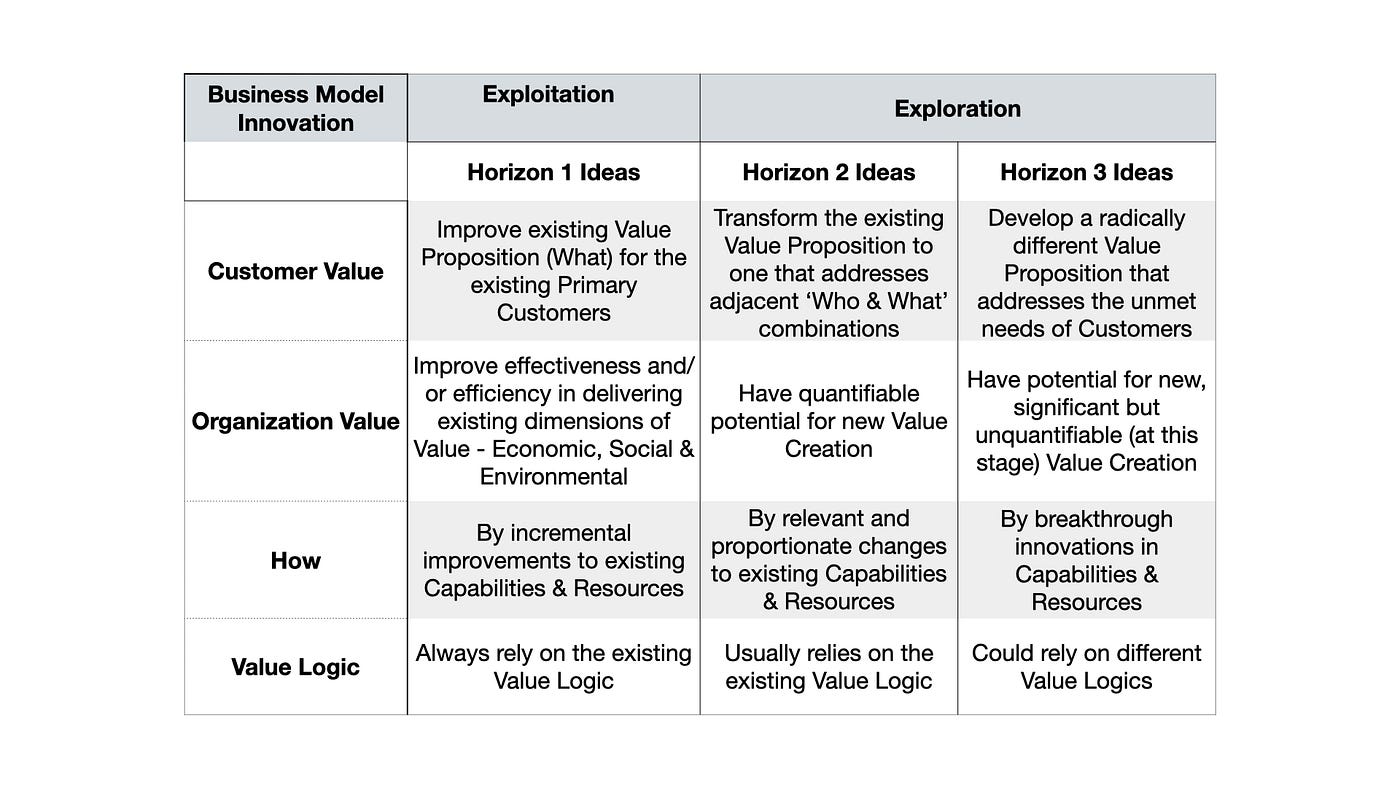

Designing Strategy Conversations involve elaborating the Horizon 1, 2 and 3 Ideas inherent in the Alternative Futures developed during the Making Sense Strategy Conversations stage. In Designing Conversations each Alternative Future is framed in terms of its Value Logic and its unique configuration of Customer Value, Organization Value and How. In other words, this stage involves designing a new, prototype Business Model for each Alternative Future. From there, each prototype is iteratively tested and refined based on its potential to create Customer and Organization Value. The final step is to make choices on which prototypes to drop and which ones to take into the Making Things Happen Conversations stage.

Horizon 1 Business Model prototypes represent ‘tweaks’ to the existing Business Model. They aim to deliver additional Customer and Organization Value by incremental gains in efficiency and effectiveness driven by improved capabilities and resources. They’re add ons to the existing Business Model so are relatively easy to design and test.

Horizon 2 Business Model prototypes represent transformations of the existing Business Model. They aim to deliver substantial gains in Customer and Organization Value by focusing on adjacent markets, offering new ‘Who & What’ combinations as well as new capabilities and resources to enable those combinations. They’re more complicated to design and test.

Testing Horizon 1 and Horizon 2 Business Model Prototypes: There are five fundamental questions to answer:

1. What are the Value Creation expectations — Customer and/or Organization — of this prototype?

2. Is the prototype coherent? Is it logical, concise and consistent with the theory of value creation (the Value Logic) that underpins the existing Business Model?

3. Is the prototype integrated (? Do the components fit together into a mutually reinforcing and interdependent system of value creation activities?

4. How does the prototype improve on or leverage the existing Business Model?

5. What are the conditions that must be in place for this prototype to successfully deliver Customer and Organization Value Creation expectations?

Before talking about these questions, it’s important to recognize that they’re a complement to rather than a substitute for financial modelling and quantitative testing. Choices between modelling and testing methodologies need to be tailored to the prototype Business Model in question. There is a wealth of literature on this subject so I will not dwell on it here.

But I do want to make two brief comments on the use of assumptions in financial modelling. First, assumptions usually involve extrapolating the past and using it to predict the future. At best it’s an unreliable methodology. At worst, it’s a recipe for failure.

It’s tough to make predictions, especially about the future……Yogi Berra

Second, the temptation to ‘game’ assumptions to make the financials look better for whatever case the proponent is trying to make is always there……I’ve fallen into it and so have a lot of other managers!!!

Coming back to the five questions, the application of 1, 2 and 3 has been covered in earlier Posts in the SCIP series (see Customer Value, Organization Value and How). However, Question 4 deserves special, especially in the context of Horizon 2 Business Model prototypes .

History tells us that firms sometimes get seduced by their Horizon 1 success, by overconfidence in their own expertise and by the perceived potential in adjacent markets. They make the mistake of thinking Horizon 2 opportunities are easy tp capture. Consider two Australian examples in the hardware/DIY/home renovations arenas.

Never test the depth of the river with both feet

In 2011, Woolworths, one of two dominant retailers in the grocery supermarket business in Australia and with a significant presence in discount department stores and liquor retailing was so confident in its retailing capabilities that it entered a joint venture with Lowes from the U.S. and launched Masters in competition with Bunnings. If you’re not familiar with Bunnings, it is the Australian version of Home Depot. Bunnings was well established at the time, highly profitable and growing strongly. I talked about Bunnings in the Making Sense Strategy Conversations Post.

In late 2016, five years after the first Masters’ store opened, the chain was closed down with accumulated losses for Woolworths of over $A3 billion. Despite Woolworths proven expertise in grocery retailing Masters failed to tick the boxes in all five questions. They focused on the number of store openings but missed the critical importance of store locations; they ignored key Customer segments and their value expectations; and the Business Model was neither coherent nor integrated. It was an unmitigated disaster that led to wholesale departures at board and management levels and a serious erosion of market value.

Ironically, around the same time, Wesfarmers (Bunnings parent company) announced the $A705 mill acquisition of Homebase, a struggling UK home improvement chain. This was Bunnings first big move offshore. The Homebase Business Model was quite different to Bunnings in terms of Customers; the product/service range; the stores and their locations; and the supply chain. The expectation was that installing Bunnings management and expertise would turn Homebase around. But instead of developing and testing changes to the Homebase Business Model the newly installed management swamped it with the Bunnings Business Model. Two years later, Wesfarmers announced the sale of Homebase with accumulated losses and write-downs around $A1.7 bill.

There was a lot of talk in the media about the old chestnut — good strategy, poor execution — with Masters and Homebase. But I don’t buy that. I’ll write more about both disasters in a future Post (The Execution Myth). The key point at this stage is that Horizon 1 expertise and prior performance, no matter how strong, do not necessarily lead to success in Horizon 2 markets.

Question 5 also deserves special mention — what are the conditions that must be in place for this prototype to successfully deliver Customer and Organization Value Creation expectations? In concept this is very similar to Roger Martin’s ‘What Would Have To Be True’ question.

Conditions for Success can be reverse designed from the prototype Business Models. They can include macro environment, industry, market and competitive factors as well as those specific to the prototype under consideration. The test involves positing why a prototype will work rather than finding reasons why it won’t, which is a particularly useful approach to combat the negative thinking that often comes into play in firms when the status quo is challenged.

Once Conditions for Success have been identified they can be evaluated based on how likely they are to be true. This is a subjective test but nonetheless it provides an assessment of risk which informs choices between prototype Business Models. Identifying the Conditions for Success also highlights potential barriers to success that may need to be addressed in Making Things Happen Conversations. Finally, it enables these Conditions to be tracked and linked to firm performance in Revising Strategy Conversations.

As an example, Bunnings recently announced its “biggest ever category expansion” — the launch of around 1000 pet care products into 270 of its 400 retail outlets. One obvious Condition for Success for this Horizon 2 idea would be that Bunnings Customers will change from their current Petcare provider to Bunnings. In Australia it’s normal practice for most retail outlets to allow only assistance dogs inside. But Bunnings have allowed dogs inside their outlets for several years now. It’s common to see little Ellie May or even big Hank sitting up in a shopping cart while their owner wanders through the aisles. It’s even become trendy. There is now a Facebook page for the Dogs of Bunnings (https://www.facebook.com/dogsbunnings/).

Was this prescience on the part of Bunnings? Was the firm establishing a pattern of Customer behaviour in advance of their Pet Care category expansion, one that was intended to foster a Condition to Success? I suspect yes. And next time I go to Bunnings I expect to see Ellie May, Hank and numerous other fluffy dogs sitting in their carts beside a tin of paint, some BBQ tools, other household paraphernalia, a dozen tins of dog food, and a new dog bowl………….

Who participates in designing new Horizon 1 and 2 Business Model prototypes? Ideally design and testing of ideas should be a co-creation effort between Business Development executives and senior operational managers. The former should provide not only overall co-ordination but also a perspective outside the existing Business Model, one that is consistent with the Alternative Futures developed in the Making Sense Conversations. The latter should provide an ‘on the ground perspective’ of the potential Customer and Organization Value Creation associated with specific ideas and on how the existing Business Model might be modified to deliver this value.

Designing and Testing Horizon 3 Ideas: By definition, a Horizon 3 idea involves addressing an unmet Customer need. The idea might stem from science and technology, from changing market forces, societal trends, government regulation and so on. Regardless, it is an idea in search of a Business Model. Designing and testing a Business Model to commercialize that idea is very different to the process for Horizon 1 and 2 ideas. It proceeds through an iterative and messy cycle of Customer Discovery, Customer Validation and Business Model Discovery.

I’ll cover this process in more detail in a future Post but for now it’s important to recognize two key points. First, designing and testing Horizon 1 and 2 Business Model prototypes is about answering the five questions previously posed. However, designing and testing Horizon 3 prototypes is quite different. In the words of Clay Christensen:

The language that is characteristic of this stage is the language of questions, not of answers

Second, Horizon 3 ideas are typically managed outside the existing business. Why? Because Horizon 3 ideas will usually involve a different Value Logic to the existing business and so will require a completely different set of Business Model exploration capabilites. Some businesses set up corporate incubators, separate business units that operate at arm’s length to the core business and are dedicated to the development of Horizon 3 ideas. Some, like big Pharma companies, contract out much of the work on Discovery and Validation.

* * * * * * * *

Like Making Sense Strategy Conversations, Designing Strategy Conversations are not linear. They’re iterative and messy. The more you practice them, the better your strategy is likely to be.

Questions or comments are always welcome.

Leave a reply to Making Strategy Happen – Strategy Conversations In Practice Cancel reply